Analyzing the Increase in Negative Equity Properties in Colorado’s Real Estate Market

Understanding the Current Market Reality

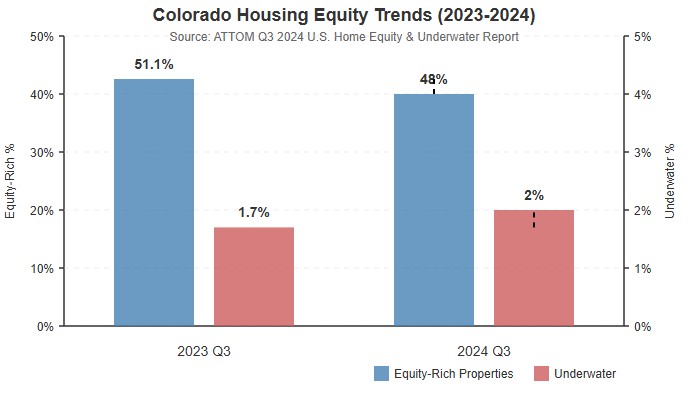

Recent market data reveals a concerning shift in Colorado’s real estate landscape. According to ATTOM’s Q3 2024 U.S. Home Equity & Underwater Report, Colorado has experienced a notable increase in “seriously underwater” properties—homes where owners owe at least 25% more than the current market value. The percentage of seriously underwater homes in Colorado rose from 1.7% to 2% year-over-year, placing it among the top five states with the largest increases in this category.

This trend coincides with a significant decline in equity-rich properties across the state. Colorado’s percentage of equity-rich homes (those with at least 50% equity) has fallen from 51.1% to 48% during the same period, one of the most substantial decreases among western states. These simultaneous shifts—fewer equity-rich properties and more underwater mortgages—signal an important inflection point in our market’s trajectory.

*Above illustrates Colorado’s concerning equity trend—as equity-rich properties decline and underwater mortgages increase, more homeowners are approaching negative equity territory, creating potential distress scenarios for recent buyers with minimal down payments.

Key Insight: While the 3.1% decline in equity-rich properties might appear modest, it represents one of the most substantial decreases among western states and gains significance when paired with the simultaneous 18% relative increase in underwater mortgages year-over-year. Colorado is one of only five states experiencing this concerning directional pattern in both categories.

Understanding the Significance of Colorado’s Equity Trends

When analyzing Colorado’s shifting equity position, it’s important to look beyond just the absolute numbers. The 3.1% decline in equity-rich properties from 51.1% to 48% represents a meaningful trend for several key reasons:

Regional Context and Comparative Performance

Colorado isn’t experiencing this trend in isolation. According to ATTOM’s data, western states collectively are seeing equity-rich levels decline, with Colorado among the top five states with the largest decreases (ATTOM Q3 2024 U.S. Home Equity & Underwater Report). This places Colorado’s performance within a broader regional pattern rather than attributing it to statistical noise or market anomalies.

Directional Consistency Across Metrics

What makes this trend particularly noteworthy is the simultaneous movement in both key metrics—equity-rich properties declining while underwater mortgages increase. These opposing movements occurring in tandem amplify the significance of both shifts and suggest a consistent underlying market dynamic affecting property values.

Rate of Change vs. Absolute Numbers

While the absolute numbers changed by 3.1% and 0.3% respectively for equity-rich and underwater properties, the relative change in underwater mortgages represents an 18% increase year-over-year. In market forecasting, this rate of change indicates a potential acceleration in the trend that warrants attention, particularly as home values adjust to current economic conditions.

Leading Indicator Properties

In housing market analysis, equity position changes often function as leading indicators that precede more significant market shifts. Historical data from previous market downturns shows a correlation between rising underwater mortgages and subsequent foreclosure activity. According to ATTOM’s foreclosure reports, there’s typically a delay between negative equity increases and corresponding rises in foreclosure filings, as homeowners initially try to maintain payments despite financial pressure.

Economic Indicators Supporting This Trend

Multiple economic factors suggest this negative equity trend is likely to accelerate:

Persistently High Mortgage Rates

Despite Federal Reserve rate cuts, mortgage rates remain stubbornly elevated. Economic forecasts from the Mortgage Bankers Association project 30-year fixed rates will end 2025 at approximately 6.5%. This elevated rate environment creates refinancing obstacles for homeowners facing equity challenges.

Regional Housing Market Slowdown

The Denver metropolitan area, which represents a significant portion of Colorado’s housing market, shows particular vulnerability. Current market analysis indicates price weakness with “minor price dips into 2025 before a slight rebound.” Meanwhile, Colorado Springs housing inventory has increased by 33% year-over-year according to February 2025 data, creating downward pressure on values in certain neighborhoods.

The “Lock-In” Effect

The Colorado Association of Realtors identifies another concerning dynamic: homeowners with mortgage rates below 5% are reluctant to sell and sacrifice their favorable financing terms. This “lock-in effect” reduces market liquidity precisely when more flexibility would benefit those facing equity challenges.

National Economic Headwinds

Broader economic indicators suggest increased risk factors ahead. The Conference Board Leading Economic Index (LEI) declined by 0.3% in February 2025, with consumer expectations turning more pessimistic. These warning signs of economic headwinds could accelerate negative equity through potential employment disruptions and reduced buyer demand.

The Hidden Complexity of Distressed Property Transactions

What the statistical data doesn’t capture is the extraordinary complexity involved in successfully navigating underwater property transactions. Having specialized in this area for years, I’ve observed that these transactions typically involve:

- Multi-phase lender negotiations spanning 3-6 months

- Comprehensive financial documentation requirements

- Specialized market analysis to justify valuations to lenders

- Coordination between multiple lien holders with competing interests

- Management of precise timeline requirements with minimal margin for error

This complexity explains why most investors—even experienced ones—avoid distressed properties despite their potential. The investment of time and specialized knowledge required creates a significant barrier to entry.

Impact on Colorado Homeowners

For homeowners facing negative equity, the consequences extend beyond the statistical data:

Financial Inflexibility

Underwater homeowners cannot access home equity loans or refinance to lower rates. This restriction creates particularly acute challenges during periods of economic uncertainty or unexpected expenses.

Mobility Constraints

Homeowners with negative equity face significant obstacles when needing to relocate for employment or family reasons. Selling at a loss typically requires bringing cash to closing—a financial impossibility for many.

Foreclosure Vulnerability

Historical patterns confirm that negative equity often precedes foreclosure when homeowners experience income disruption. When a homeowner can’t sell for enough to cover the mortgage balance, their options narrow dramatically if financial difficulty arises.

Market Outlook: 2025-2029

Economic forecasts provide important context for understanding the trajectory of underwater properties:

Short-Term Projections (2025-2026)

Multiple analyses from financial institutions and real estate authorities indicate slowing price appreciation ahead. According to Fannie Mae’s survey of housing experts, home price growth is expected to decelerate to 3.8% in 2025 and 3.6% in 2026, compared to 5.2% in 2024.

This deceleration, combined with Colorado’s already declining equity-rich percentage, suggests more properties will approach or cross into negative equity territory—particularly those purchased near market peaks with minimal down payments.

Long-Term Considerations (2027-2029)

Looking at the five-year horizon, the U.S. News Housing Market Index projects that home prices will rise at approximately “a percentage point or so above the rate of inflation” through 2029. This modest appreciation rate creates a prolonged period where underwater homeowners will struggle to regain positive equity through market forces alone.

Professional Solutions for Distressed Properties

Successfully addressing underwater mortgage situations requires specialized knowledge in several key areas:

Short Sale Expertise

Short sales—where lenders agree to accept less than the full mortgage balance—require detailed understanding of lender-specific requirements and negotiation strategies. Based on my professional experience working directly with major lenders’ loss mitigation departments, each institution has unique documentation standards, timeline requirements, and approval thresholds that significantly influence outcomes.

Loan Modification Knowledge

In certain scenarios, loan modifications provide viable alternatives for homeowners with sufficient income but temporary hardships. From my practice in this field, I’ve found these arrangements typically require precise financial analysis to demonstrate the borrower’s ability to maintain the modified payment structure, along with comprehensive documentation of the hardship’s nature and expected duration.

Foreclosure Prevention Strategies

For properties approaching foreclosure, several time-sensitive intervention strategies exist that can still preserve homeowner credit and create equitable resolutions. Through years of working with distressed properties, I’ve developed expertise in identifying which approach—whether short sale, deed in lieu of foreclosure, or other alternatives—best suits each homeowner’s specific situation and timeline constraints.

Conclusion: A Resource for Colorado Homeowners and Investors

The increasing prevalence of underwater properties in Colorado creates challenges for homeowners but also opportunities for properly prepared investors. As economic indicators suggest this trend will accelerate, having access to specialized expertise becomes increasingly valuable.

If you’ve encountered a distressed property situation—whether as a homeowner seeking solutions or an investor who’s identified an opportunity—professional guidance can make the difference between a successful outcome and a costly learning experience.

With 15 years of experience on my team, contact me directly to stop any foreclosure date. There are multiple ways to do it effectively and safely.

For a confidential consultation about a specific property or situation, please contact me directly at troy@icorockies.com or schedule a one-on-one discussion at https://calendly.com/icorockies/property-review-w-troy-miller-home-solutions-realty

With years of focused experience navigating these complex transactions, I welcome the opportunity to assist homeowners facing these challenges or collaborate with investors who discover potential opportunities but lack the specialized knowledge or bandwidth to execute these time-intensive projects.