Increasing Reconstruction Cost in Colorado

Since the Marshall Fire in late December 2021, many property owners are more concerned about having enough replacement cost coverage in their insurance policies in the event of a total loss. Damage from the Marshall Fire event spanned both commercial and residential structures. The estimated loss in residential structures was nearly $630 million and $250 million on commercial properties based on Verisk reconstruction cost data. Total estimated costs are expected to exceed $1,000,000,000.

Unfortunately, many of these structures appear to have been underinsured. As so many homes and businesses were underinsured, it shows the importance of having an annual insurance review to make sure that coverage is adequate in the event of a total loss (like a fire). I cannot emphasize how important it is for the customer or the Agent to do annual insurance review.

Reconstruction cost value is the cost to replace or rebuild a home to original or like standards at current material and labor costs. Over the last few years, we have experienced large increases in labor and material costs as well as a shortage of a skilled artisan contractors, all of this creates a gap in building coverage. Unfortunately, this was another reason why the homes in the Marshall were underinsured.

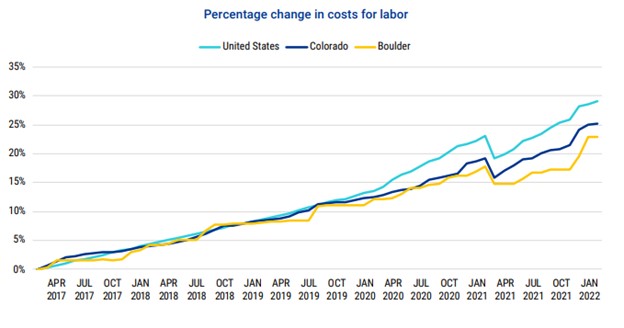

Verisk Analytics which is a data and risk assessment recently reported the total reconstruction cost increased significantly in the past 5 years. Colorado and Boulder County have tracked closely with the national trends, which pushed prices up more than 30 percent as of February 2022 compared with 2017. Most of the increase still comes from the persistent high lumber prices which peaked in July 2021. This is the result of a high demand market with an increase in building activity. Furthermore, labor costs have grown steadily over time. Due to the shortage of Artisan Contractors, many are traveling from other states to help satisfy the demand to repair or rebuild the damage properties. This also can drive up building and material costs.

Reconstruction cost is also affected by each city’s new requirements and expenses associated with updating the dwellings to meet current building ordinances. For example, in many counties in Colorado new roofing codes will require a class 4 asphalt shingle roof to protect the home against large hailstorms.

Climate change has also affected the property insurance market and the reconstruction cost with the several wildfires in the west that have burned millions of acres. We are also seeing large increases in severity and frequency in Tornadoes, Wildfires and Hurricanes. The high demand to rebuild these structures, will also be reflected on the cost of labor and materials nationwide.

Insurance companies must adjust to the new reconstruction costs to keep up with the building costs, labor costs, new city codes, as well as increased severity and frequency of claims. Trying to balance these exposures can be very difficult as they are increasing so rapidly.

If you would like to have complete reconstruction cost analysis, contact your agent to make sure you are properly covered. I can also work with you on your reconstruction costs for your investment properties and buildings.

Highlights:

- The home replacement cost is the amount it would take to rebuild your home with similar materials if it is damaged or destroyed.

- Insurance companies will use interior features and external features, types of flooring, roofing material, personal belongings, code changes, as parameters to calculate home replacement cost.

- Replacement cost or reconstruction cost are based on current cost of labor and materials & supply demand.

- Verisk data shows more than 1,000 structures with over $880 million of reconstruction cost value were reported destroyed or damaged in the Marshall Fire.

*360Value Quarterly Cost Update Q2 2022 Marshall Fire Analysis (verisk.com)