Procrastination Buries Opportunities

It has been said that “Procrastination is the grave in which opportunity is buried.” * I’ve spoken with countless people, and an overwhelming majority have what is perhaps a well-intended thought that, some day, when I’m ready, I’ll start. When it comes to implementing your own Private Family Banking System and build it to a point where you can be doing amazing things with it, such as funding a half a million-dollar purchase and rehab in full… you have to start somewhere.

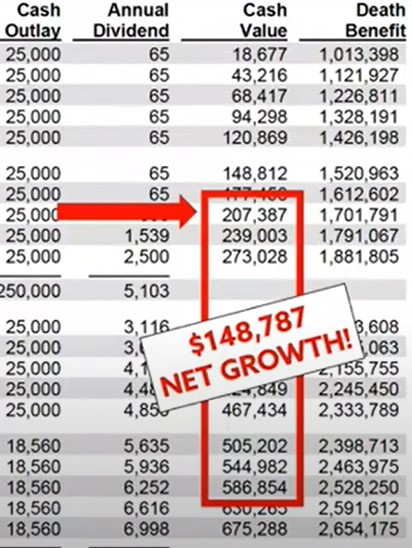

I want to show you an example of what one 30-year-old person can be doing by the time they’re 38. Watch how over the next 10 years, they not only grow passive income and increase equity, but they also create an additional $15,000 a year of income tax free growth inside a properly structured cash value Whole Life Insurance policy. This is not your grandmother’s policy. This is structured to have robust cash value growth from day one, and compound in growth year over year, even while it’s out being used to make money elsewhere.

By the time Mr. Investor reached age 38, he had built up just over $207,000 in cash value. He borrows against his policy that year a sum of $200,000 for real estate deals. Now typically, an investor can make one of two choices – pay cash for one home, or down payments on 4 homes. Hopefully, you choose the 4-home option. Leverage is our friend in the real estate game.

Based on some common numbers, he’ll be cash flowing $479 per month on each home. Over the next 10 years, he’ll pull in $22,992 per year. Over the next 10 years, the mortgages will be paid down, while at the same time the value of the homes will presumably go up by some 30%. This is why we do what we do when it comes to buy & holds! Now let’s factor in the cash value from his policy. Over that same 10-year period, he’ll pay in $230,680 in premiums. His cash value will grow from $207,387 to $586,854 (less the $200,000 that is out). That means his net cash value growth will be $148,787! That’s an additional average $14,878 per year, of cash value that he can utilize for other deals, or however he sees fit. If he sets up a repayment plan for that original $200,000 loan from his policy over that 10 years, he’ll have the full $586,854 to use by age 48. Or he could choose to keep the $200,000 out for the 10 years (but why?), and he’d still have $386,854 to utilize (586,854 – 200,000).

Did I also mention that even though $200,000 will be out of the policy, being used on something that’s going to make him money, the cash value will still be growing inside policy at a rate as if it never left. No other vehicle can you do this with! And furthermore, the $200,000 ‘loan’ against the policy is an unstructured loan where you decide how you’re going to pay it back, over how long, and how much. And did I also mention that the $148,787 net cash value growth inside the policy is not taxable when structured and accessed properly?

There is no other vehicle with this many advantages. Call me today and let’s come up with your own personalized plan. Now is the time.

*Quote by Alyce Cornyn-Selby