Why Is My Investment Property Building Limit and Insurance Premium Increasing?

One of the most important things to know when you own a Home, or an Investment Property is making sure you have enough coverage on your building in the event of a total loss. Your Agent or Insurance carrier should prepare an annual replacement/reconstruction cost analysis to confirm you have enough coverage to rebuild your structure/building in the event of that catastrophic event, like a fire that results in a total loss. Reconstruction cost value is the cost to replace or rebuild a home to original or like standards at current material and labor costs. Over the last few years, we have experienced large increases in labor and material costs as well as a shortage of a skilled artisan contractors, all of this creates a large increase in the building coverage replacement cost analysis.

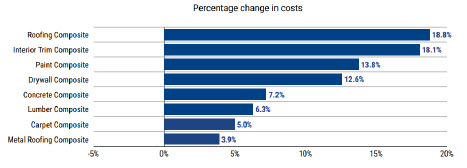

Verisk Analytics which is a data and risk assessment recently reported a combined increase in reconstruction cost of 11.5 percent from 2021 to 2022. This inflation in reconstruction cost makes it particularly challenging for property insurers to maintain insurance-to-value. This is the result of a high demand market with an increase in building activity and supply shortages due to the pandemic since 2020.

Furthermore, contractors are incurring higher cost not calculated before such as increase cost of materials, delayed material deliveries, higher expenses for insurance premiums and shortages of employees due to covid exposure.

Reconstruction cost is also affected by each city’s new requirements and expenses associated with updating the dwellings to meet current building ordinances. For example, in many counties in Colorado new building codes will require a class 4 asphalt shingle roof to protect the home against large hailstorms.

Climate change has also affected the property insurance market and the reconstruction cost with the several wildfires in the west coast that have burned millions of acres. In addition to the tornados and hailstorms in other parts of the country. The high demand to rebuild will be reflected on the cost of labor and materials nationwide.

Insurance companies must adjust to the new reconstruction rates year after year to calculate their premium and forecast their future claim’s volume. Insurance carriers must first request approval from the state’s Department of Insurance through a rate filing before announcing the rate increases to their insureds.

If you would like to have complete a reconstruction cost analysis and compare your premium with other carriers, contact a trusted insurance agent who understands the new reconstruction cost in your area. I can also prepare an updated insurance analysis for your investment properties and buildings.

Highlights:

- The home replacement cost is the amount it would take to rebuild your home with similar materials if it is damaged or destroyed.

- Insurance companies will use interior features, external features, types of flooring, roofing material, personal belongings, code changes, as parameters to calculate home replacement cost.

- Replacement cost or reconstruction cost are based on current cost of labor and materials & supply demand.

- Insurance companies are regulated by the Department of Insurance by each state when there is a rate increase.

*360Value Q4 2022 Quarterly Reconstruction Cost Analysis (verisk.com)

*360Value Q4 2022 Quarterly Reconstruction Cost Analysis (verisk.com)