You Have to Start Somewhere.

There are many people reporting (breathlessly) that the real estate market is about to crash. The main things that get blamed are rising interest rates, a cooling economy, and prices having risen ‘too far too fast’, but there’s also the impact of inflation, wages, an insufficient supply of homes, crazy zoning policies, rents and demographics to consider. With all of these variables, what’s to be done? Let’s take a minute and consider two things: first, a bit of context and second, the direction, magnitude, and timing of any decline.

First, a bit of context. Markets move around, and they swung too far in favor of sellers this past spring. Blame seasonality or COVID (or the response) or whatever, but the market strongly favored sellers. Clearly some of the silliness in the spring - like forcing buyers to waive inspections and bidding wars that resulted in a final sales price 20% above asking - is not sustainable, so should we be overly concerned when the market returns to normal? There are still some issues in the market, and not everyone can afford the house they’d like, but really the market is in a much more rational and balanced position now.

Buyers got pretty excited in the spring as well, and we saw some pretty creative justifications for paying higher prices. Buying and rehabbing homes to put into a short-term rental pool, scrapes, short-term holds, etc. were discussed. Now, we are seeing much less of that. David Nielson, head of Boomerang lending, observes: “We are getting a lot more requests now for ‘regular’ financings. Borrowers that plan on taking a mid-priced older home and updating it and selling it in line with the market. And we are having a much easier time being on the same page with the after-rehab value. Our borrowers have been through the cycles and it’s just returning to normal. The good news is they are having an easier time finding projects that pencil now and no more crazy waits for cabinets and cement.”

Given that the market was not sustainable at the elevated levels, should we expect some pullback in prices? That certainly seems reasonable. But direction, magnitude and timing still matter. If the direction of house prices is likely lower, how far will they fall? And how fast? The consensus seems to be in the neighborhood of a 10% pullback[1], which hardly fits the definition of a ‘crash’. The last major pullback, which does seem to qualify as a crash, prices declined by over 25%, but that took more than 5 years[2]. And how fast matters. During that last time (on a national level) there were no 6-month periods during which the prices declined by more than 10%. An average developer (our borrowers really add value, not just ‘flip’) makes about 25% on their investment, which means there will still be profit in the event of the type of declines we saw last time.

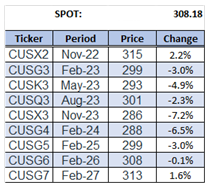

It still would be helpful to have a bit more granularity as to direction, magnitude, and timing, and fortunately it is available. The Chicago Mercantile Exchange which trades billions of dollars daily in futures on such investments as the S&P 500, interest rates (bonds) and various commodities, has a way to invest in the housing markets. The S&P Case-Shiller index[3] allows you to look at the ‘bets’ (or hedges) being placed on the national level of home prices. The way these futures work is that on settlement day, the current price (the ‘spot’ price) is compared to the price of the contract and the difference is settled (in cash) between the counterparties. The current spot price is 308.18. We can compare that price to the futures price and determine what these investors are figuring will be the price at that point in the future. Here’s what that looks like at present:

So people that actually make investments based on housing prices expect a 7.2% decline in prices by next year in November, which is probably quite different from the talk you hear on tv or at the bar. And also, quite supportive of starting new projects. Want to go even more granular? There are also futures on house prices in Boston, Chicago, Denver, Las Vegas, Los Angeles, Miami, New York, San Diego, San Francisco, and Washington DC.

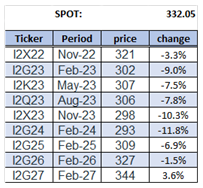

It should come as no surprise that the Denver market looks to take a bit of a harder hit than the national average, with the futures market expecting a decline of almost 12% by February of 2024[4]. That should come as little surprise given the marginal outperformance of Denver area prices over the last year by just about the same amount of the extra decline (Denver was +19.3 % over the last 12 months vs +18.0% for the National Average).

Markets change and we are through the silly season that was this spring and back to a relatively normal market. Certainly, there are still concerns, but pessimistic prognosticators seem to be quite out of line with people that are actually making investments, in both current and planned future markets. Therefore, we can pretty confidently say, there is a light at the end of the tunnel and it’s not an oncoming train.

[1] See for example:

https://fortune.com/2022/09/13/210-housing-markets-at-risk-of-15-to-20-home-price-declines-says-moodys-housing-crash/

[2] https://fred.stlouisfed.org/series/CSUSHPISA

[3] https://www.cmegroup.com/markets/real-estate/residential/SandP-case-shiller-price-index.html Retrieved 13 September 2022 12:35 pm

[4] https://futures.tradingcharts.com/futures/quotes/I2.html Retrieved 13 September 2022 12:35 pm