What Will Be the Impact of Rising Rates?

What happened last time rates rose aggressively and there was a demographic driver pushing up demand for homes? That is exactly the questions asked in “The Baby Boom, The Baby Bust, and the Housing Market”, an article published by Harvard in 1989 that looked at housing prices in the 70s and 80s. The conclusion is that the huge demand driven by demographics overrides all other factors, including interest rates, which is even more stunning considering rates rose during that period from 10% to 18%.

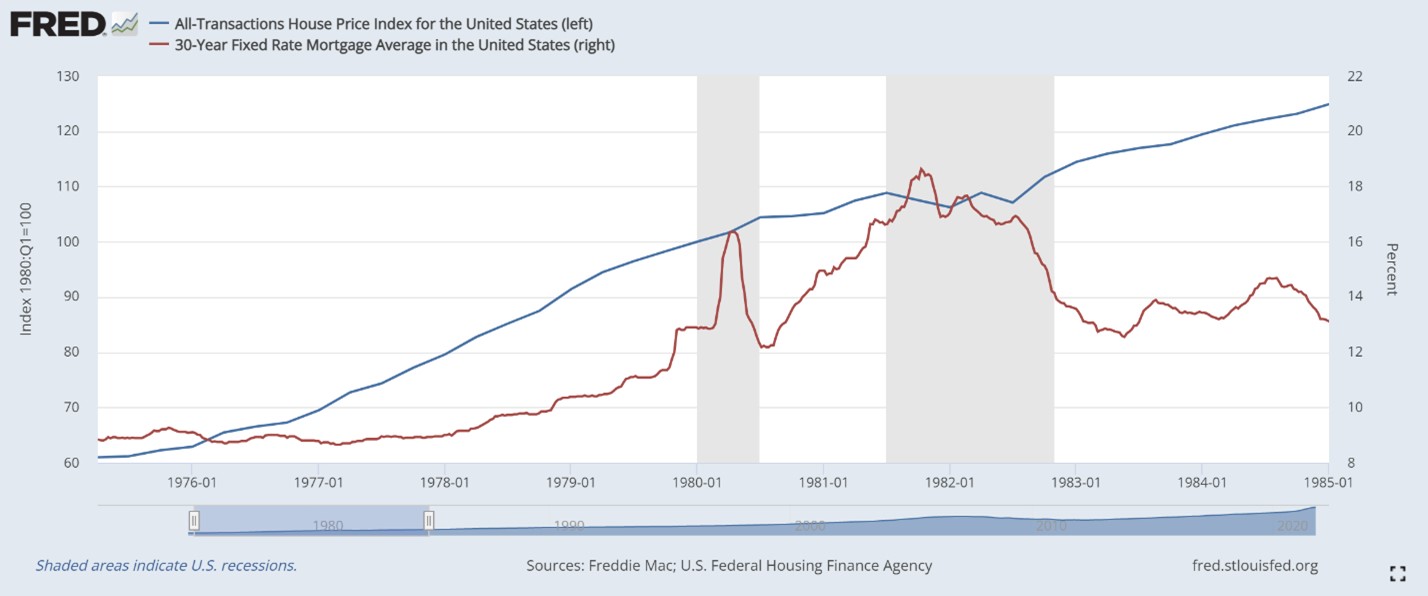

This is extremely relevant to our industry now, and although we don’t speculate on SFR, we lend to it, so of course we end up intently focused on it. Even just eyeballing the data suggested the two (rise in rates and demand for SFRs) really aren’t correlated, and ‘something else’ is going on. Here is a chart of home prices vs interest rates from 1975 to 1985, with the blue line representing home prices and the red representing rates, and the shaded zones are recessions. This must have been a head-scratcher then too.

So, last time it was the Boomers, this time it’s the Millennials, and we feel confident of a continued increase in home prices, albeit at a much slower pace. And of course, there will be some localized pullbacks-and-froth in asking prices. which should come off as well, and indeed we have been seeing that over the past month or so. Asking prices have gotten pretty silly at more than $400 per square foot, but they have been settling back down to much closer to something that will actually trade, around $300 per square foot. However, this certainly doesn’t mean an overall ‘collapse’, and comparing traded prices to traded prices (instead of asking prices to asking prices) will be a much less volatile, and more realistic, series.

Rates can rise, but housing demand seems well underpinned by demand, just like when disco reined supreme.